QuickBooks is considered to be the finest accounting software, as it rolls in with amazing features and functionalities. This accounting software is a boon, especially when it comes to carrying out the day to day accounting operations. The only drawback of this software is that it is prone to certain errors. QB users have reported various errors in the recent times, one of the most common is the QuickBooks payroll error 15106. If you are facing such an error, then reading the article ahead will be of great help to you.

In today’s article, we will be talking about the facts, causes, and fixes for the QuickBooks error code 15106. Thus, make sure that you read the post carefully. Another alternate for tackling the issue can be to consult our QuickBooks support team at toll-free number i.e. +1-844-719-2859. We are a hub of technically sound technical support professionals, who work round the clock to provide the best possible support services. Thus, do not hesitate in calling us anytime, we will be happy to help you.

You might also read: How to troubleshoot QuickBooks error 15241?

What is QuickBooks error code 15106?

The QuickBooks error code 15106 is basically a payroll update error, which means something is stopping the software from updating all versions of QuickBooks desktop. The user gets an error message stating as:

Error 15106: The update program cannot be opened

or

Error 15106: The update program is damaged

This sort of error is usually seen when the user is trying to download the QuickBooks desktop updates. The user will get an error message that the user is unable to launch the updated program. If you are also facing such an error, then continue reading the article.

Factors causing the QuickBooks 15106

The QuickBooks error code 15106 can be seen due to various factors, which includes:

- If the antivirus application installed in the system is blocking the update

- After that, in case the user is not logged in as admin in the system, as the ability to read and write new files gets restricted without admin credentials.

- Or, if the spy sweeper is present in the Webroot antivirus software, then it takes QB update program as malware and it would lead to such an error.

Also, if the user is having an active QuickBooks desktop payroll subscription, the user might need to download the latest tax table after each step, in order to avoid and ensure that the payroll information isn’t affected.

Methods to fix the QuickBooks error code 15106

After that you are well versed with the above stated facts related to the payroll update error 15106, it is time to look for some effective solutions to resolve the issue. There can be a couple of solutions that the user can follow in order to resolve the QuickBooks error 15106. Let us explore each of the methods one by one:

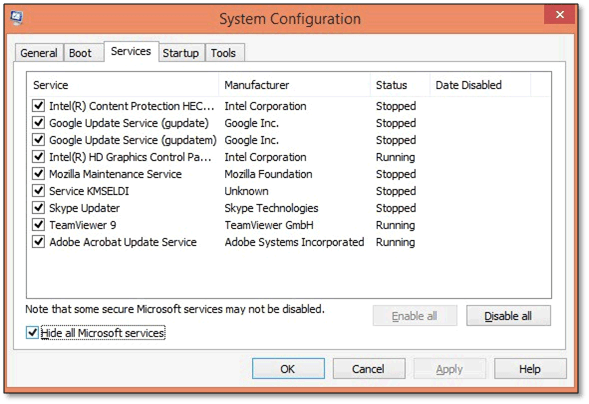

Method 1: Clean installation of QuickBooks in selective startup mode

The very first method to try out is to clean install QuickBooks in selective startup mode. This process demands a couple of steps namely:

- The very first step is to create a backup of the company file

- And then, keep a copy of the QuickBooks product and license number

- After that, the user needs to start the system in selective startup mode, for ensuring that no other application is hindering the task completion

- The next step is to uninstall or install QuickBooks desktop

- At the end, the user needs to switch back to the normal startup mode.

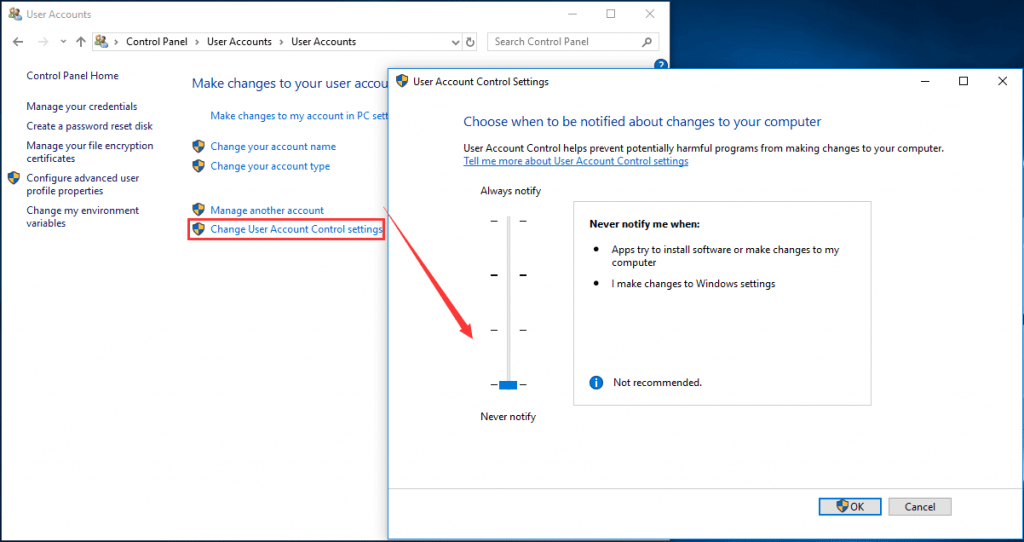

Method 2: Turn OFF UAC (User Account Control)

If you are a Windows 10, 8.1, 8, and 7 users, then you need to carry out the below steps, in order to turn off UAC.

- To begin with, the user needs to press the Windows + R keys and then open the run window

- After that, type in control panel and hit OK button

- The next step is to select the user accounts and also ensure to select user accounts

- And then, click on change user account control settings tab

- And also, move the slider:

- The user needs to set it to Never Notify and then click on OK tab, for turning off UAC

- Or the user can set it to always notify and then hit OK, in order to turn on UAC

- At the end of this process, you need to reboot the system

See Also: How to Fix QuickBooks Error Code 392?

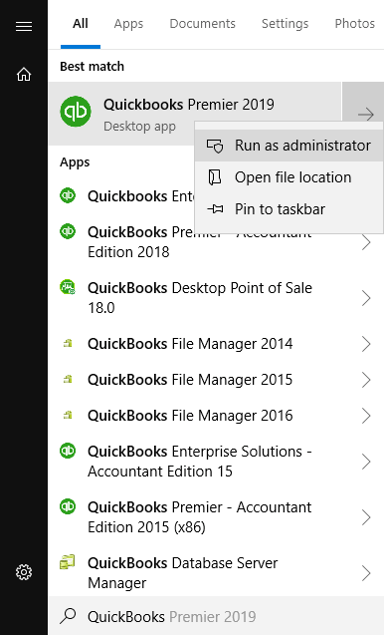

Method 3: Log in the system as Admin

The user is recommended to log in the system with admin credentials. In case you have logged in as a different user, then in that situation, the user must login as admin. For this, the user needs to simply right click the QuickBooks icon and then choose the run as admin option. This will change the access to admin, and the user will get admin privileges and it is expected to resolve the issue.

Method 4: Stopping Antivirus and renaming folders

This is the last method that one can opt for, in order to resolve the QuickBooks error 15106. To stop antivirus and renaming folders, the user can carry out the steps below:

- The very first step is to press Ctrl + Shift + Esc keys to open the task manager

- After that, move to the processes tab and also look for the .exe file

- The next step is to select the end process option

- And then rename the QuickBooks update folder

- This can be done by pressing Windows + E keys and open the file explorer

- After that move to C:\ProgramFiles\Intuit\QuickBooks(year)\Comments

- And then, for 64 bit users, the user needs to move to C:\ProgramFiles(x86)\Intuit\QuickBooks(year)\Components

- After that, right click on the downloadqbXX folder and then click on the rename option. Also note that XX here depicts the version of QuickBooks

- Also, add .old to the end of the name

- The last step is to end the process by re-updating QuickBooks desktop.

See Also: How to resolve QuickBooks point of sale error code 176109?

Final Words!

In an attempt to help you in fixing the issue, we have summarized the quick fixes of QuickBooks error 15106 in this particular post. After you are thorough with the above steps and methods, then you can successfully resolve the payroll error.

However, if you continue to face the issue even after carrying out the steps and procedures, the you can consult our QuickBooks premier technical support team right away at our toll-free customer support number i.e. +1-844-719-2859. Our experts and certified accounting professionals will help you out in getting rid of the issue with much ease.