QuickBooks offers some great features, one of which is QuickBooks payroll. The payroll services that the QB software offers to the users are highly beneficial to all sorts of businesses, regardless of the fact whether they are small or medium. As this feature allows the entrepreneurs to pay their employees, without having to get into too much hassle. However, the payroll might come up with certain errors at times, one of the most common one can be QuickBooks payroll error PS033. If you are also facing any such error, then this post can work wonders for you.

QuickBooks error PS033 generally occurs when the CPS folder carries certain damaged file. This prevents the user from downloading the recent updates related to payroll and at time also stops the user from opening the company file. Tackling QuickBooks payroll error PS033 can be a huge task for the QB users. Keeping that in mind, we have come up with this post, where we will try to discuss the causes and also the quick fixes to the error PS033.

However, if you are short of time, or you want a team of expert to fix the error PS033 for you, then another alternative for you can be to get in touch with our QuickBooks premier technical support team via our toll-free number i.e. +1-844-539-0188. Our experts and certified professionals here to help you round the clock.

You might also like: How to fix QuickBooks error code 6123?

What is QuickBooks payroll update error PS033?

Before you jump on to QuickBooks payroll fixation steps, it is better to first understand what is QuickBooks error code PS033. This error code comes up with an error message stating:

“PS033 Error: QuickBooks can’t read your payroll setup files”.

This basically indicates that the file in the CPS folder is damaged. This error might also lead to losing certain essential data. This error mostly results into failure in downloading to the latest payroll updates and the user is unable to open the company file either. There can be multiple factors causing this error, which will be discussed later in this post.

See also: How to fix QuickBooks error code 1904?

How QuickBooks payroll update error PS033 is caused?

As mentioned earlier, the major cause of QuickBooks payroll update error PS033 is when the CPS folder containing the damaged file, and it would restrict the user from downloading the payroll update. There can be various other factors leading to this sort of error, a few of the common ones are listed below:

- The very first reason can be if the status on QuickBooks desktop appears as invalid number or EIN.

- The user can also encounter this type of error, in case of incorrect service key.

- Also, if the user is using an outdated QuickBooks version, then this error is most probable to happen.

- Another factors can be if the QuickBooks data gets damaged.

- If in case the non-activation of the payroll subscription

- The user can also end up in this error if the inactive direct deposit agreement has more than one active payroll.

- Wrong service key can also be one of the reasons.

- Error PS033 can also be seen if the invalid employer identification number is used

- If the company file PSID is wrong, the error could be seen

- Also, in case the current windows version is not compatible with the QuickBooks desktop, then error is probable to happen.

You might also read: How to resolve QuickBooks error code 6150?

Methods to resolve QuickBooks error PS033

There can be more than one method that the user can opt for, in order to get rid of QuickBooks error PS033. Let us check out each of the methods one by one:

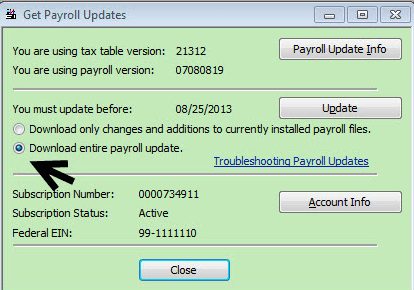

Method #1: Rebooting and fixing in safe mode

- The very first step is to run a Verify and rebuild data in QuickBooks desktop

- After that, the user should update QuickBooks desktop to the latest release

- And then, reboot in safe mode and then update the QuickBooks payroll tax table

- Lastly, the user should restart the system.

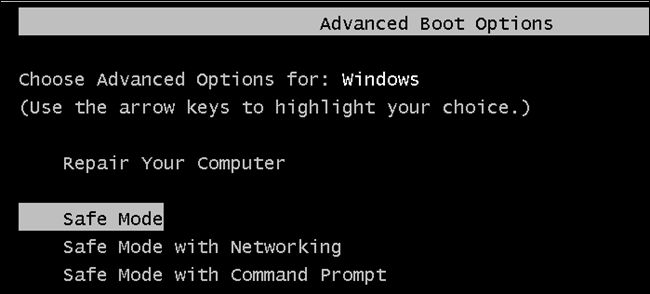

Method #2: Downloading the latest payroll tax table

- The user can now move to the method to download the latest payroll tax table

- In this method, the user will have to select the employees’ option and then get payroll updates

- After that, the user should select the download entire payroll update option

- Followed by select update and you are good to go.

Method #3: Changing the name of QuickBooks CPS folder

- In the process of renaming the CPS folder, the user will have to first visit the path as: C:\Program Files\Intuit\QuickBooks 20nn\Components\Payroll\CPS. The point to be noted here is that is mentioned here is the version number of QuickBooks just like the year of QuickBooks version.

- The next step in the process is to rename the CPS folder to CPSOLD

- And then lastly update the QuickBooks payroll tax table.

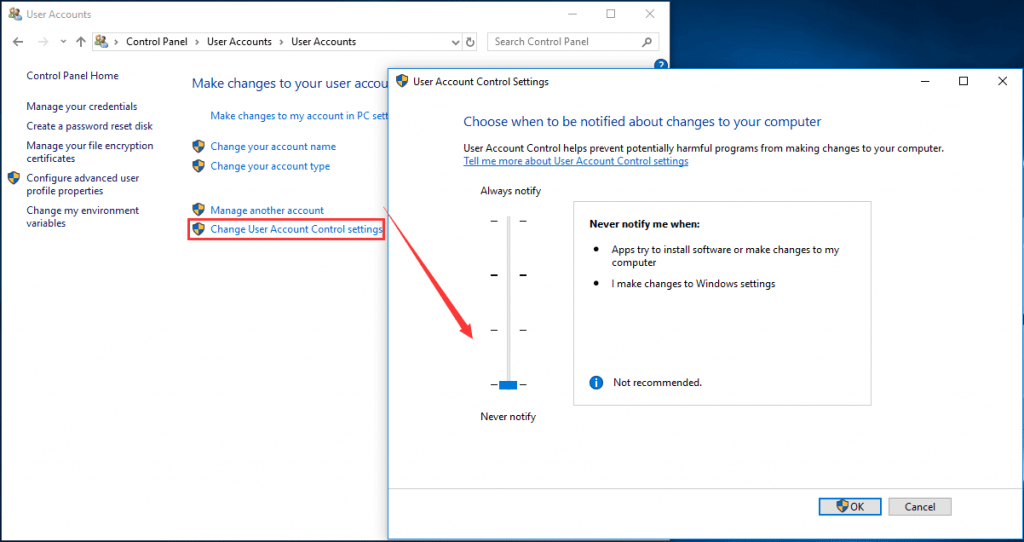

Method #4: Turning off UAC (User account control)

This method is application for the UAC settings change (Windows 10, 8.1, 8 and 7). The steps to be followed are:

- The initial step in this process is to press Windows + R keys, in order to open run window

- After that, the user will have to write control panel and look for it

- The next step is to hit a click on OK tab

- Moving ahead, the user needs to click on User accounts.

- And then select user accounts classic view.

- Now, move to change user account control settings

- And then move the slider and hit never notify option.

Final Words…

Well, that’s it with this article. We hope that the information we have shared with you and the solutions mentioned in this post might be of some help in getting rid of QuickBooks payroll update error PS033. However, if error continues to trouble you, or if by any chance, you are facing any sort of difficulty in tackling this issue, do not hesitate in discussing the issue with our QuickBooks support team. Talking to our experts and certified QB professionals will help you in fixing the error without any further hassle. Just ring up at our toll-free number i.e. +1-844-539-0188, and our team will be there to assist you in a single call.