Stumbled upon QuickBooks error code 3180 and unable to decide what to do? Well, need not to worry, as we are here to help you. QuickBooks error 3180 is seen while using QuickBooks desktop sales tax item is not associated with any vendor. This can also happen when the account mapping of sales tax payable account is incorrect. Also, the user can also face such an issue due to one or more items on receipts having the sales tax payable account selected as the target account.

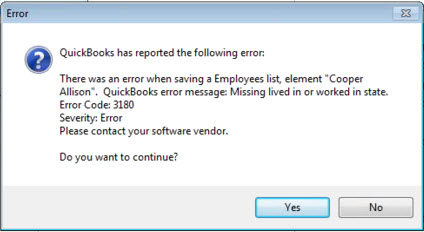

You may see following error messages on your desktop screen:

Status code: 3180 Status message: There was an error when saving a Employees list, element “Employee, Name”

Status code 3180: There was a problem with saving the General Journal Transaction

Status code 3180: …QuickBooks error message: A/P (or A/R) detail line must have vendor

Status code 3180: QuickBooks error message: The posting account is invalid

Status code 3180: Status message: There was an error when saving a Items list, element “XXXXXXXX”. QuickBooks error message: The posting account is invalid. 140108 payment item lookup error “XXXXXXXX”.

Status code 3180: Status message: There was an error when saving a Sales Receipt

Status code 3180: Status message: Sales tax detail line must have a vendor

Status code 3180: Status message: There was an error when saving a Sales Receipt (or Credit Memo). QuickBooks error message: Sales tax detail line must have a vendor.

There can be a few methods that can resolve the QuickBooks POS error code 3180. To know more, make sure to read this post carefully till the end. Or you can also get in touch with our professionals at our toll-free customer support number i.e. +1-844-539-0188. Our team will ensure to provide you immediate technical assistance, and will surely fix the error for you.

Steps to resolve QuickBooks error 3180

The user can resolve the QuickBooks error code 3180, by carrying out any of the below steps:

Step 1: Merging items in QuickBooks

The user can merge the items in QuickBooks and try to fix the error. The steps to be followed here are as follows:

- The very first step is to open QuickBooks desktop

- And then, move to the list

- Also, navigate to the item

- Followed by selecting to include inactive

- Once done with that select the type header to sort the list

- Another step is to right click the payment item that begins with point of sale

- The next step is to select edit items

- Now, the user needs add OLD to the item name

- The user is then required to select edit item

- And then, remove OLD

- The next step is to select OK tab

- Followed by running the financial exchange from you point of sale

- And in the software, merge the duplicate items

- After that right click the payment method with OLD

- Also, select edit item

- And remove OLD

- And also select OK tab

- Lastly, tap on Yes to confirm

You may also like: How to Fix QuickBooks Error Code 1601?

Step 2: Ensuring that one has not paid out the problem receipt using sales tax payable

- For this, the user needs to open QuickBooks point of sale

- And also select sales history

- Right click any column

- Followed by selecting customize columns

- Now, ensure to select the QuickBooks status

- Once done with that look for receipts that are not completed yet

- Also, select the receipt if any of the receipts are paid out to sales tax payable

- And click on reverse receipt

- Now, recreate the paid out using a non-sales tax payable account

- The last step is to run financial exchange

Step 3: ensuring that you assign the vendor to the sales tax item

- The user is supposed to open the QuickBooks desktop

- And then move to the list

- And navigate to the item

- Also, select include inactive

- The next step is to select the type column to sort the list alphabetically

- The last step is to ensure all sales tax item have a tax agency attached to it.

Read Also: How to Solve QuickBooks Error Code 7010?

Step 4: Selecting tax preferences

The user can also select tax preferences by carrying out the steps below and try to fix the error:

- At first, the user needs to open QuickBooks point of sale

- And then move to the file option

- The next step is to select preferences

- And select company

- After that click on accounts under financial

- Once done with that tick the basic and advanced tabs

- The last step is to make QuickBooks sales tax payable is only listed in the sales tax row. And change it and run financial exchange if it not.

Read Also: How to Fix QuickBooks Banking Error 102?

Conclusion!

With this we come to the end of this article, where we expect that the information shared in above might help in fixing the QuickBooks error code 3180. However, if the error continues to trouble you, or in case of any query, give us a call at our toll-free customer support number i.e. +1-844-539-0188. Our QuickBooks desktop support experts and certified professionals will ensure to provide the immediate technical assistance.