QuickBooks Direct Deposit form is the most effective and easiest way to pay your employees. Writing off paychecks and handwriting daily takes much time and effort. But, by using direct deposit forms you can save writing time and loaded activities. It is convenient for employers as they can collect employee information, bank information, and essential authorization to manage payroll. Note: If the employer wants the employee to enter their personal banking and tax information, ensure the employee’s self-setup is on.

Employees will get an invitation mail from QuickBooks via QuickBooks Workforce. In this article, we will be briefing you about setting up the QuickBooks Payroll Direct Deposit Form. You can contact our team of experts to learn more or ask any questions regarding QuickBooks. To contact us dial our number +1-844-719-2859.

Also Read: How to Get Instant Deposits in QuickBooks Desktop?

What is QuickBooks Direct Deposit Form?

Direct deposit forms authorize a third party. Often, employers will transfer money to your bank account for payroll purposes simply by using your account details. It requires a canceled check to verify accounting information by the employer. After the form is completed it has to be signed and returned to the employer.

Steps to Set Up Direct Deposit Form

Below listed are the steps that are required to be performed to set up the QuickBooks Direct Deposit Form.

Step 1: Set up your company’s payroll for direct deposit

- Identify and access company, bank, and principal officer information.

- Connect your bank account.

- Please check your bank account.

- Set up direct deposit for employees.

Step 2: Obtain the Direct Deposit Authorization Form.

If the employee completed, signed, and dated the Direct Deposit Authorization Form and attached a check that was canceled from the employee’s bank account, select Payroll in the next step.

QuickBooks Online Payroll

- You must first go to “Taxes” and then select “Payroll Taxes.

- When finished, select Filings and select Employee Settings.

- You must now select Bank Verification in addition to Direct Deposit Authorization.

- The final step is to select view options.

QuickBooks Desktop Payroll

- It requires a completed direct deposit authorization form and a canceled check from the employee’s bank account.

- It is important to note that authorization forms and voided checks are for record-keeping purposes only and do not need to be sent to QuickBooks.

You might find it helpful: Intuit Customer File Exchange – Download and Upload Files

Step 3: Add Direct Deposit to the Employee

Once you complete this setup, the next paycheck you create for the employee will be a direct deposit. You must select a salary to set it up.

QuickBooks Online Payroll

- First, you need to go to Payroll and select Employees.

- In the next step, select the employee.

- Also select “Start” or “Edit” for the payment method.

- Now you need to select the “Direct Deposit” option from the “Payment Method” ▼ drop-down menu.

- Also select a direct deposit method (splits can be dollar amounts or percentages).

- Direct deposit to one account

- Direct Deposit to Two Accounts

- Direct Deposit Balance as Check

- Next, enter the employee’s canceled check routing and account number and click Done.

QuickBooks Desktop Payroll

If your employee’s bank indicates that the account must be designated as a money market account, select the checking account option because QuickBooks Desktop only accepts checking or savings accounts.

- Here you have to first select Employee and then select Employee Center to open the employee list.

- Next, select the employee’s name.

- Also select the Payroll Information tab.

- Next, you need to select the Direct Deposit tab.

- In the Direct Deposit window, select Use Direct Deposit for the employee’s name.

- Next, decide whether to deposit the paycheck into one or two accounts.

- Next, enter the employee’s financial institution information (bank name, routing number, account number and account type).

- Now, if you decide to deposit two accounts, simply enter the amount or percentage that the employee would like to deposit into the first account in the Amount to Deposit field.

- The remainder will be sent to the second account.

- You must also select the OK tab to save your information.

- Finally, enter your direct deposit PIN when prompted.

Also Read: Reconcile Payroll Liabilities in QuickBooks – Complete Guide

Steps to Get Employee Direct Deposit Authorization Form

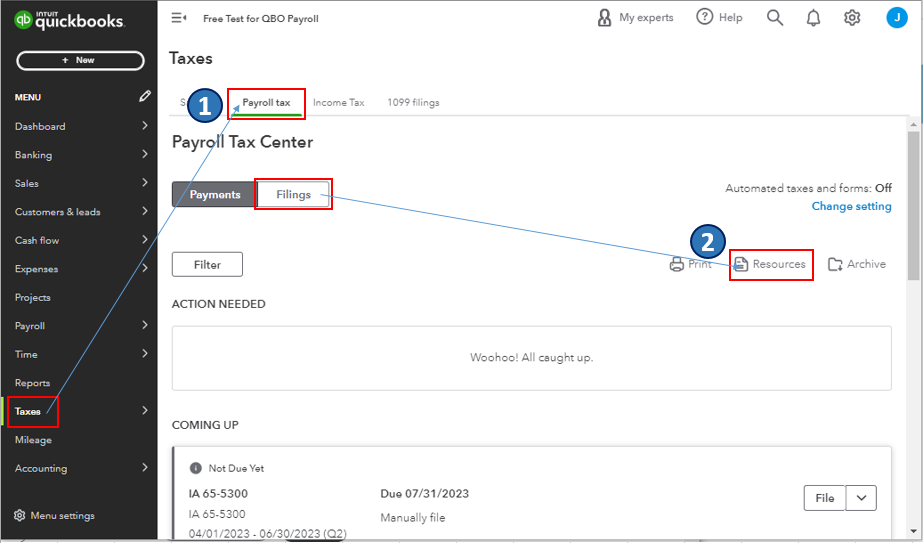

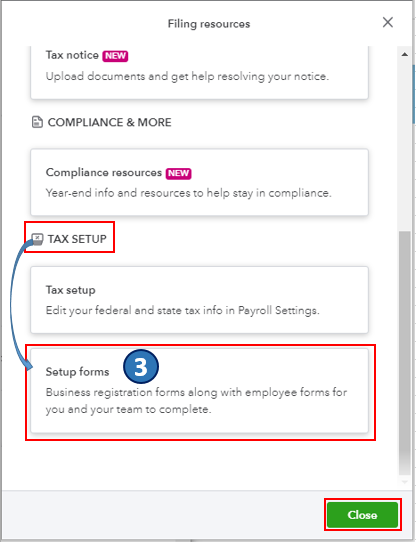

To get the employee direct deposit authorization form in QuickBooks online firstly you have to go to the filing resources window and set up employees’ direct deposit in payroll.

Note: The employees and contractors who are going to get paid with direct deposits in payroll must have to fill out the complete direct deposit authorization form.

- First of all, go to the Taxes menu and select payroll tax.

- Now select the filings tab and hit resources.

- After that in the filing resource window and scroll down to the tax setup section.

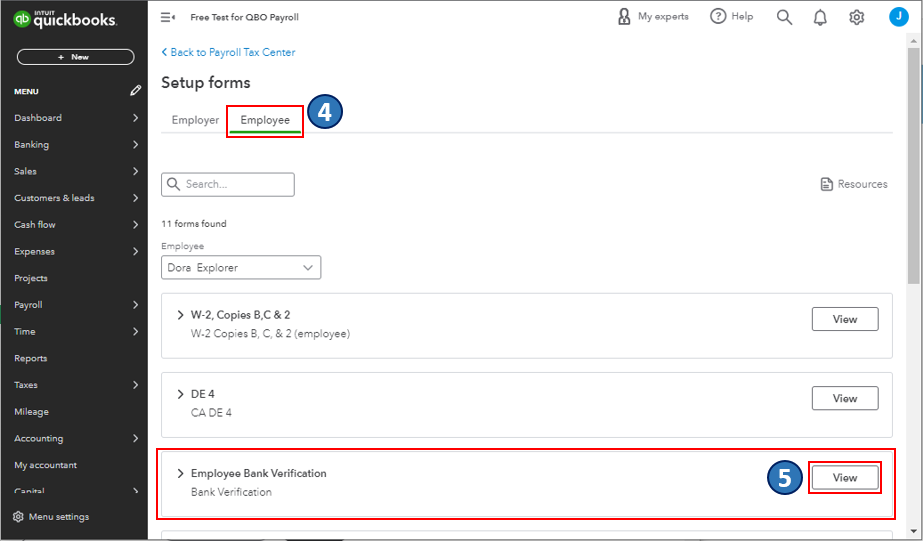

- Select the setup forms and navigate to the employees option.

- Now find the employee bank verification section and click on the View option.

- Here you will be routed to the form’s PDF file.

- Lastly, download and print the employee direct deposit authorization form.

Once completed, follow the steps required to set up and manage employee direct deposit in Payroll above. Additionally, there are various payroll reports that you can use to view information about your company’s finances and employees.

You might find it helpful: What is QuickBooks runtime redistributable?

Conclusion:

QuickBooks online payroll provides you more flexibility with employee self-onboarding as you can enter employees’ info. You can also invite the employees to add the rest. It is not that, if you want to still print a direct deposit authorization form you can do it. In this article, we have described the complete process to Set Up QuickBooks Direct Deposit Form. In case of any confusion and doubts, you can ask for assistance to our tech support team. To contact our team, dial our tollfree number i.e. +1-844-719-2859.

Frequently Asked Questions

Does QuickBooks have a direct deposit form?

Yes, QuickBooks offers a direct deposit form that helps employers gather relevant information about their employees and further manage payroll.

Where can I find the Direct Deposit form in QuickBooks?

You can use the following steps to find the Direct Deposit form in QuickBooks.

- Go to the Payroll tab.

- Also select employees.

- Next, select Direct Deposit from the Payment Method ▼ drop-down menu.

How do I verify direct deposits in QuickBooks?

You can use the following steps to verify direct deposits in QuickBooks.

- Sign in using your Intuit account login information.

- Next, go to the “Payroll Information” section under your direct deposit account.

- Then select Validate.

- Enter and confirm your billing PIN.

- Finally, click Submit to complete the process.

What is the Direct Deposit Form?

The Direct Deposit Authorization Form is a form that employees complete to authorize their employer to deposit money directly into their bank account. Many companies pay their employees by direct debit.

Other Related Articles:

How to Undo or delete a Reconciliation in QuickBooks Online?

How to Delete a Journal Entry in QuickBooks?