After the user verifies the data in QuickBooks, at times he/she might land into a QBWin.log error on the screen. This usually occurs if the company file items are damaged. QuickBooks users might find this error to be a bit confusing, as it is not a very common error. This would come up on the screen with an error message as:

“QBWin.log: LVL_Error—Error: Verify Item: Invalid Tax Agency”.

There can be a handful of reasons causing QBWin.log: LVL_Error–Error: Verify Item: Invalid tax agency issue which we will be discussing later in this article. Thus, make sure to scroll through the post carefully till the end.

However, if you feel the QBWin.log: LVL_Error–Error: Verify Item: Invalid tax agency issue to be bit too confusing for you or you find the issue to be difficult to handle, then in that case you can simply get in touch with our customer support team. Ring up to us at our toll-free customer support number @ +1-844-719-2859, and leave the rest on us. Our team of experts and certified ProAdvisors, will be happy to help you.

What causes the QBWin.log: LVL error-Error: Verify Item: Invalid tax agency?

As we said before, the verify utility might detect this issue, due to a couple of factors, which includes the following:

- The item list might have damaged items and invalid information might have been entered in the tax agency field for one or more non-sales tax items

- Or if the damaged items show non-vendor names, like the customer names, in the preferred vendor field.

The user needs to edit each of the damaged items listed in the QBWin.log file, in order to remove the invalid information. It should be noted that the tax agency field is reserved for sales tax items and is not seen for other types of items. If the user changes any item in any way and saves it, this will remove the invalid tax agency information from that item. The most important point is that the user should not export, edit, and re-import the item list to try to resolve the issue.

You may also consider: Display QuickBooks hidden files & folders or search for files using Windows

Solution to the QBWin.log: LVL_Error–Error: Verify Item: Invalid tax agency

The user can fix the QBWin.log: LVL_Error by carrying out the below listed steps one by one:

Step 1: The very first step is to identify the damaged item using the QBWin.log

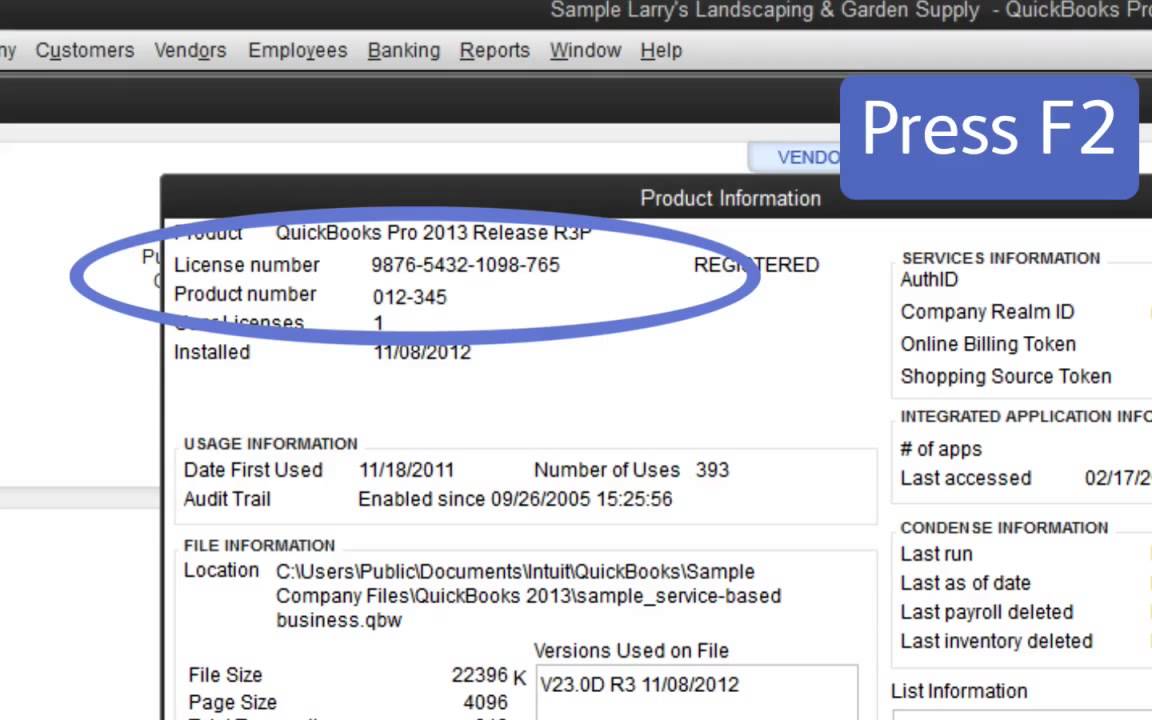

- In this step, the user needs to press F2 key while the software is open, in order to open the product information window.

- After that, the user needs to press the F3 key, and open the tech help window and also move ahead to the open file tab.

- The user needs to spot the QBWin.log from the open file tab and then hit on open tab.

- Once done with that and the QBWin.log is open, the user needs to press Ctrl + F keys to bring up the find window and also look for the error.

- The last step is to note the damaged item name on the line that follows the issue,

See this also: How to Resolve the QuickBooks Error 1310?

Step 2: Editing the damaged items

Once done with the steps above, the user needs to edit the damaged items. The steps to followed here are:

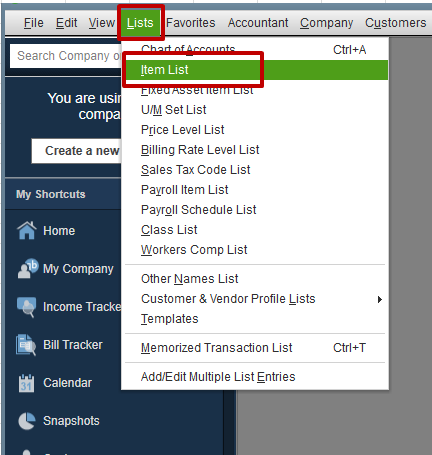

- The user needs to move to the list menu in QuickBooks and select item list.

You may also like: How to Fix QuickBooks Payroll Error PS058?

- After that, the user needs to spot the damaged items shown in the QBWin.log and also double click the edit tab.

- Once done with that, the user needs to verify the preferred vendor filed.

- In case the preferred vendor field is right, or in case there is no preferred vendor field in the item, the user needs to add or delete a character from the item name or description to change the item, and then hit OK tab.

- In case of preferred field being incorrect, the user needs to eliminate the name or assign the accurate name and also click on OK tab.

- This particular step is not mandatory, but the user can double click the item again to edit it and then reverse any of the changes made to the name of the description field and also hit OK.

- The user is supposed to repeat the steps above for each of the item in the QBWin.log file having the QBWin.log: LVL_Error—Error: Verify Item: Invalid Tax Agency issue.

- The last step is to try merging the item into a new item and try to resolve the error.

Read Also: How to locate missing transactions in QuickBooks desktop?

Conclusion!

By now the QBWin.log: LVL_Error–Error: Verify Item: Invalid tax agency issue might have been resolved with the help of the above stated steps. But if in case you have any query or in case you continue to face the same issue even after following the above steps, then you can get in touch with a team of experts and certified professionals.

You can call us at our toll-free customer support number i.e. +1-844-719-2859, and discuss your queries with our QuickBooks premier technical support team. We will be happy to help you.