QuickBooks is an absolute accounting and book-keeping software. Whether users are operating the small business or large, QuickBooks is the latest and much-acclaimed software for the users. They can conveniently manipulate the market, account, payroll management, tax and other purposes with the help of QuickBooks accounting software. It comes with great specialties and very effective in improving market prosperously.

But sometimes, the users may face some difficulties while commencing the QB software due to some technical complications. These errors may end access to the software. This article will talk about how to update the payroll software to the latest version.

Similar Article: How to Update QuickBooks desktop?

Know About Update QuickBooks Payroll Software

Payroll software is a type of software that helps with recruiting employees for time worked. This software can be obtained through an HR software vendor or can be added as part of an HR software package as a module within a complete system. Basically, payroll software assists with determining paychecks from hours logged in time and attendance tracking systems. The software then carries paychecks or direct deposits funds into employees’ accounts. Taxes and deductions are also calculated and withheld by payroll programs.

Why to Obtain Payroll Software?

Payroll is something that has to be done perfectly and regularly, it makes sense for companies to invest in a system that automates these methods. Payroll software can assist to mitigate errors and improve compliance while saving time.

Benefits of Payroll Software

These are the various improved benefits which are shown below:-

1. Progresses Agreement

Calculating company taxes and knowing what reports to file can be confusing, missing deadlines for these items can garner hefty fines and penalties. Payroll software programs support companies by providing information and reminders about agreement needs.

2. Settles Tax Forms

Payroll software can automatically produce all tax forms that are needed by employees, contractors, and companies. It helps to release some of the stress at tax time.

You may also like: How to Fix QuickBooks error code 1311?

3. Manages all the Records Effortlessly

Keeping records with payroll software is simple and requires absolutely no physical space, as all files are stored electronically. Old data can also be accessed or deleted with the push of a button, so staying organized is simple.

4. Manage Company Needs

Not all payroll software is specifically the same, so the company needs should be assessed before vendor information is researched and reviewed.

Points to Remember

- You have an operating payroll subscription and access to QuickBooks Desktop installed on a network with an Internet connection.

- You have already started the payroll service key in your QuickBooks Desktop to activate the payroll subscription.

Steps to Update your Payroll Service Account Information

There are various steps to update payroll service which are given below –

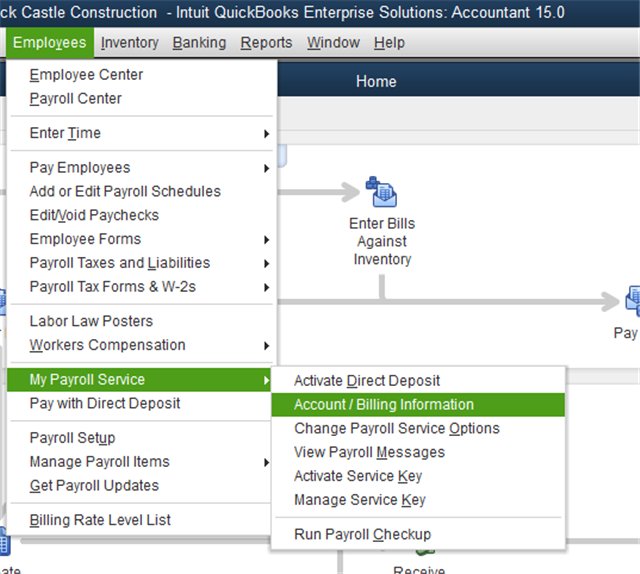

- First, Choose “Employees” > “My Payroll Service” > “Account/Billing Information” OR “Account Info/Preferences“.

- Then, Sign in working your Intuit Account login and password.

- At last, choose the information you need to update.

Update for Basic, Standard and Enhanced Payroll

1. Update and set up the bank account

- Choose “Lists“, then “Chart of Accounts“.

- Pick the “Accounts” button. Then select “New“.

- Then, select “Bank” and choose “continue“.

- Now, “Enter your bank account information“

- Choose “Save & Close” to save your changes.

Read Also: How to Fix QuickBooks Error Code 392?

2. Update the Payroll Admin information in QuickBooks

- Continue to “Employees“> “My Payroll Service”> “Billing/Bank Report“.

- Under the “Company Information” section, click the “Payroll Admin” tab.

- Now, Click the “Edit” link.

- Enter your “PIN” and tick “Continue“.

- Follow the on-screen directions to update your “Payroll Admin” report.

- “Succeed Update” – A processing request screen appears until the update is finished, which can take some minutes.

- At last, Check the updated payroll admin information and close the window.

Summary of Past Payroll Updates

| Payroll Update Number | Date Released |

| 22208 | 3/24/2022 |

| 22206 | 2/17/2022 |

| 22204 | 1/27/2022 |

| 22202 | 1/13/2022 |

| 22201 | 12/16/2021 |

| 22116 | 9/16/2021 |

| 22114 | 8/19/2021 |

| 22104 | 01/28/2021 |

| 22102 | 01/07/2020 |

| 22101 | 12/17/2020 |

| 22016 | 10/01/2020 |

| 22004 | 01/14/2020 |

| 22002 | 12/26/2019 |

| 22001 | 12/12/2019 |

| 21916 | 09/19/2019 |

| 21913 | 07/18/2019 |

| 21912 | 06/20/2019 |

| 21909 | 05/16/2019 |

| 21908 | 03/17/2019 |

| 21906 | 02/21/2019 |

| 21904 | 01/17/2019 |

We hope that this article will make you know all the steps to update QuickBooks payroll. We feel great delight in helping you, and we always embrace you over here on this platform. This post has provided all the necessary facts concerning the topic. It also includes some steps and processes that will help during the payroll updates.

Read Also: Resolve QuickBooks is unable to send your email to outlook error

Winding Up!

Further, if you ever feel the need of getting advice from your fellow business owners that happened to be our existing subscribers, you can contact our QuickBooks pro technical support team for expert advice on your issue. You can reach them at +1-844-719-2859. Our specialists are always there for you.

FAQ’S

Q 1: What is a Payroll Update?

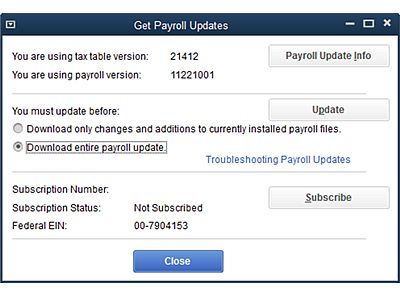

Ans QuickBooks Payroll gives payroll updates to QuickBooks Payroll subscribers. These updates present the most current and accurate rates and calculations for supported state and federal tax tables, payroll tax forms and e-file and payment options.

Q 2: Which Payroll Update Do I Have?

Ans- In QuickBooks, from the Employees menu, take Get Payroll Updates, then Update. In the Get Payroll Updates window, verify the number next to the words “You are using tax table version“. If this matches the number of the latest payroll update, you are up-to-date.

Q 3: how do I get Payroll Updates?

Ans- The most obvious way to do this is to set up automatic updates so that QuickBooks downloads payroll updates automatically as soon as they are prepared. You can further download the latest payroll update anytime while in QuickBooks.

Q 4: Is the Employee self-service portal unavailable in the trial?

Ans- According to the Getting started example, the Self-service portal settings menu must be in the Payroll Setting.

Q 5: Should we upgrade the QuickBooks version every year?

Ans- No, you do not have to “upgrade” every year – any users are still using the 2007 version. If you upgrade your network OS you will ultimately find that your old software won’t run right any longer. But you should “update” your present version every time a new set release is issued.

Read it also: How to Troubleshoot the QuickBooks Error 6144?